Join

AES

Join

AES

Contact

Us

Contact

Us

Not-for-profit (NFP) organisations and associations provide crucial services to the community.

Many of these organisations, like art centres, sports clubs, and neighbourhood associations have become the social fabric of local communities during the pandemic. They are critical for connectivity, social cohesion, safety, and extra-curricular interests for many Australians.

However, as tax reporting season gets underway, it is important that these organisations understand the tax landscape, report with accuracy, and with as much detail as possible.

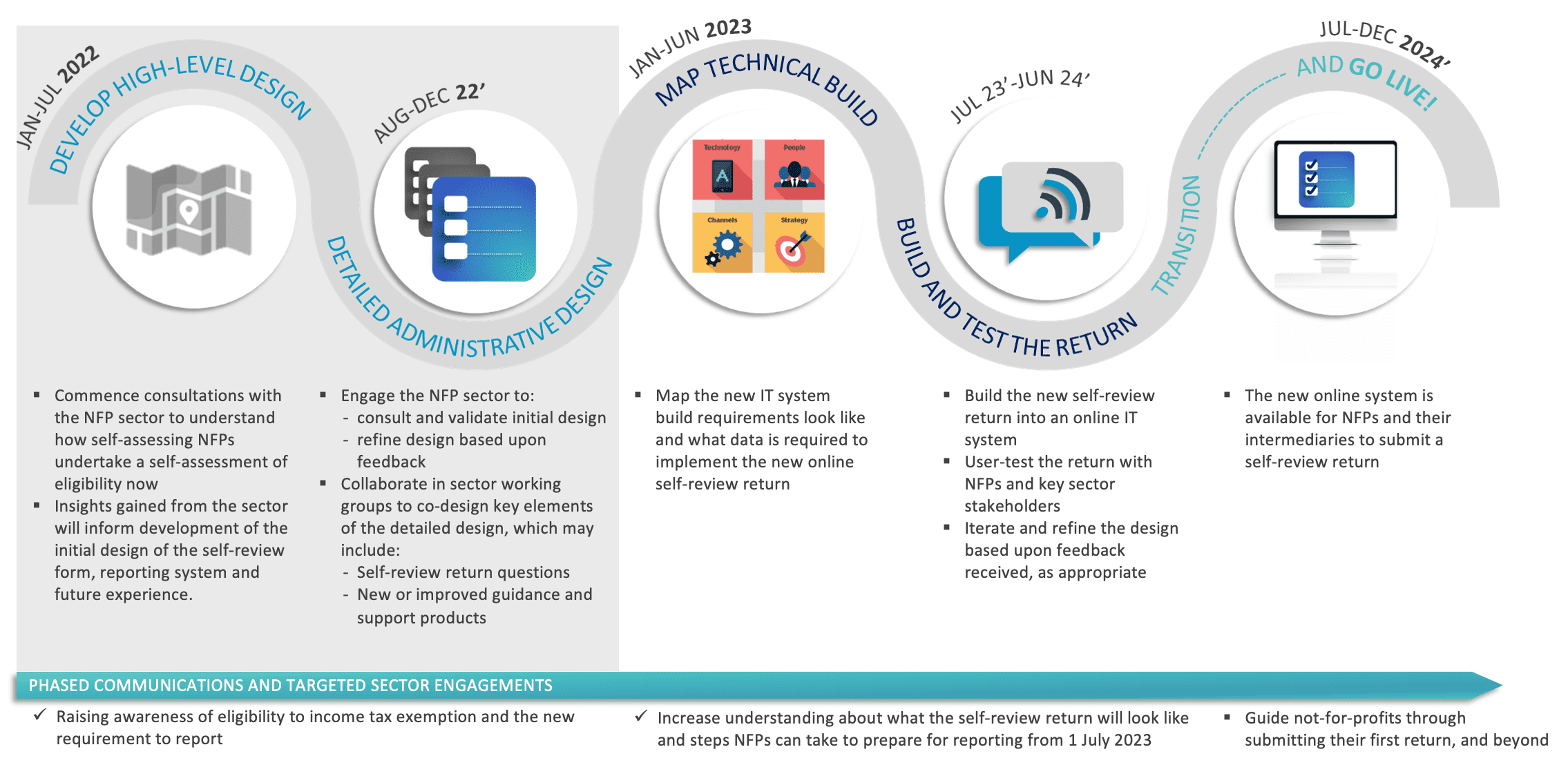

The 2021–22 Federal Budget focusses on a range of reform agendas that affect the way in which NFPs report. For example, from 1 July 2023, non-charitable NFPs with an active Australian Business Number (ABN) will be required to lodge an annual self-review return to access an income tax exemption.

The Australian Taxation Office’s Not-For-Profit (ATO NFP) Centre began an initial consultation with NFPs and peak bodies earlier this year. Together, they shared the unique characteristics that self-assess these organisations’ income tax exemptions; how they make this determination; the level of advice and guidance that may be required; and expectations for engaging about how and when to meet the new reporting requirements.

This supports a level playing field with similar regulatory requirements that are expected for non-charitable and charitable NFPs.

It also bolsters the trust and confidence that Australians have in the sector.

NFPs can complete a series of simple steps to ensure they are able to report accurately. These steps include:

Importantly, the ATO understands that many organisations may not have reviewed their eligibility to be income tax exempt. As such, the ATO will not direct resources to looking at prior years unless there is reason to believe there has been deliberate actions to evade tax, or any fraudulent behaviour.

It is a common misconception that if an organisation does not make a profit, then they are tax exempt. However, the ATO NFP Centre works with clients, intermediaries, peak bodies, scrutineers, government, other agencies and all relevant ATO business areas and capabilities to ensure there is education and support in place.

At a glance, your organisation will fit into one of three categories:

This makes up around 69 per cent of organisations. They should either meet governing rule conditions or income and asset conditions.

Some non-charitable NFPs can self-assess their income tax exemption using the eligibility criteria, which is set out in Division 50 of the Income Tax Assessment Act (ITAA) 1997

This makes up 27 per cent of organisations. These organisations should have a physical presence in Australia, be named in income tax regulations, or meet deductible gift recipient test requirements.

This includes NFPs registered as a charity with the Australian Charities and Not-for-profits Commission (ACNC) and are are approved by the ATO as being income tax exempt.

This makes up the smallest portion of not-for-profits (4%) and are not eligible for the endorsement as a tax concession charity, and self-assessment of income tax exemption.

Many of the changes that relate to tax deductions stem from a series of 2017 changes, which are designed to strengthen governance arrangements and reduce administrative complexity.

The changes impact registered charities; Australian government agencies; or organisations that are operated by a registered charity or an Australian government agency.

The legislation means 47 of the 49 general deductible gift recipient categories must be met by organisations. There are around 27,600 deductible gift recipient entities in Australia, and these new reporting requirements will affect less than 7 per cent.

There are also a range of new technologies that are unlocking the key to a stronger reporting system. For example, the Director ID function is a unique identifier that is given to a director who has verified their identity with the ATO Registrar.

A director must provide their Director ID to the record-holder of any company they are at currently, or being appointed to as a director.

The ACNC looks after nearly 60,000 registered charities in Australia.

A charity is an entity that:

Above all, charities must meet the ACNC`s Governance Standards and remain registered while undergoing their business.

You must inform the ACNC if there are changes to the charities name; changes to the governing rules; if responsible people leave or new members join the management board; and if there is a change of address.

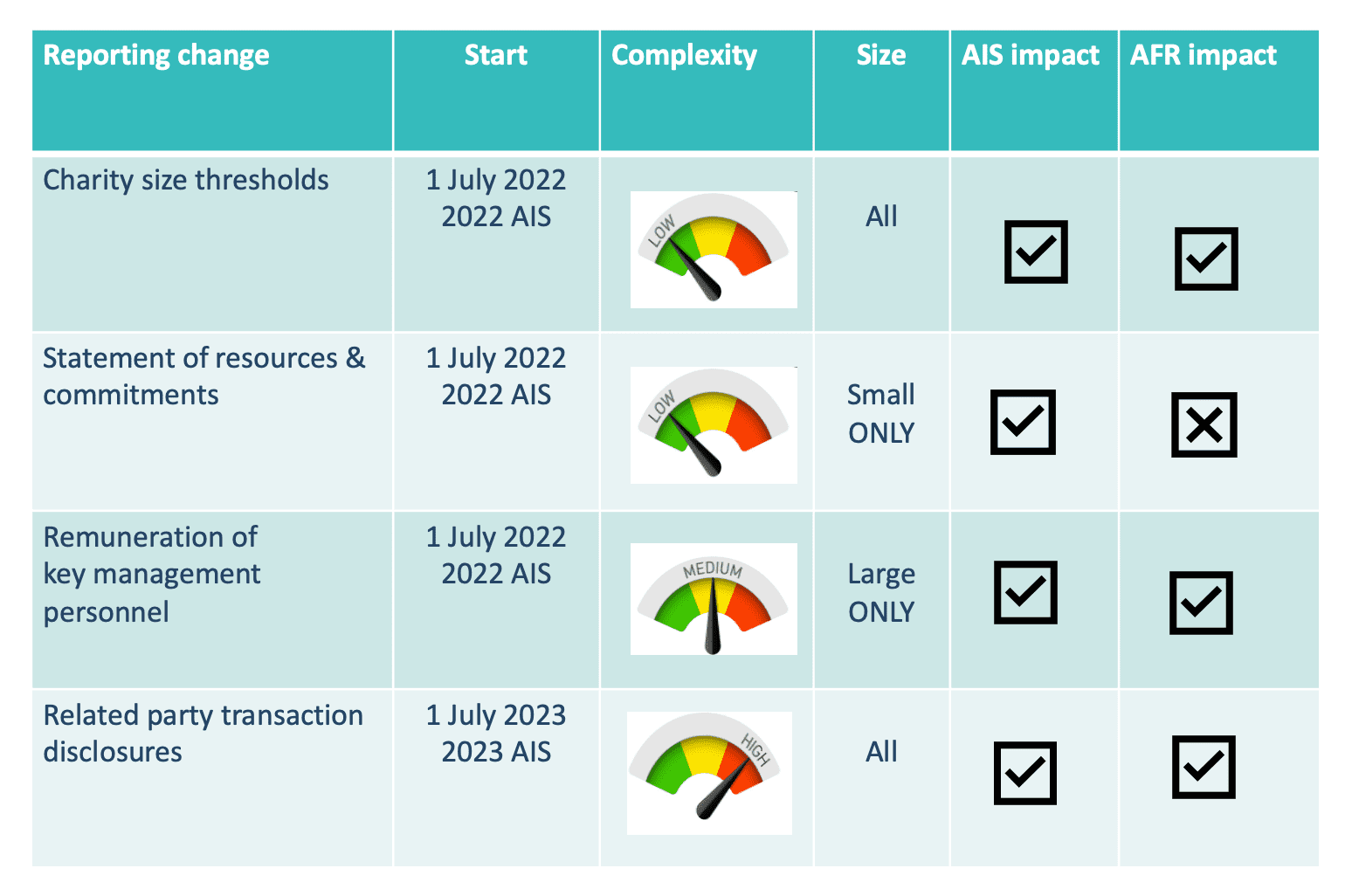

Charities must report annually and provide financial information when appropriate. Importantly, there have been some changes to charity reporting as the new financial year gets underway.

For example, all charities must report their size from 1 July 2022. In addition, smaller charities should provide a statement of resources

and commitments, and larger organisations need to provide a summary of remuneration as it relates to key management personnel.

From 1 July 2023, all organisations will need to ensure related party transaction disclosures are reported. As such, it is crucial that you stay on top of your reporting and data during the next financial year.

Making sense of the tax landscape can be a complex task but the Association Executive Services team will help you to understand the system and report with accuracy.

Please contact us, or call (03) 8393 9382.

With over 30 years of management expertise, Executive Director and Founder of AES, Nick Koerbin is one of the most experienced NFP leaders in Australia. He has held positions as the CEO of Materials Australia, the National Parts Code, as well as senior positions in the Institute of Insurance, Australian Quality Council, the Financial Planning Association, the Australian Human Resources Institute, and the Furniture Industry Association of Australia. Nick created AES with a vision of creating a set of management practices that could be consistently followed to ensure success. Over his 30 years in the industry, he noticed that inconsistent management practices often impeded delivery of services to members, which in turn created issues with membership renewal. By establishing AES and creating the NFP Association Best Practice Self-Assessment, Nick has been able to assist leaders in becoming more confident and informed decision makers so that they can create more effective strategies and implementation plans.

Disclaimer: The articles on our website are intended to stimulate interest in the subject matters. All comments and articles are for information purposes only. Professional advice should be sought on specific matters, and with lawyers under Costs Agreement and to which Legal Professional Privilege (LPP) applies.

Too often, associations are eager to expand their membership before ensuring the organisation is on solid footing. But real, sustainable growth starts from within. Before you open the doors to new members, it's essential to check that the ship is seaworthy—strategically, financially, and operationally.

How we help membership based, not-for-profit associations now and into the future.